It is back to the drawing board for Kina Bank and Westpac, as Papua New Guinea’s Independent Consumer and Competition Commission has issued a ‘final determination’ declining authorisation of Kina’s proposed acquisition of Westpac Papua New Guinea.

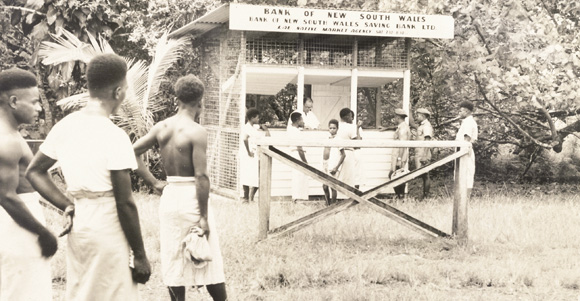

Westpac, formerly the Bank of New South Wales, has operated in PNG for over 100 years. (Pictured: The Bank of New South Wales at a Lae market in 1958. Credit: Westpac)

Papua New Guinea’s consumer market regulator, the Independent Consumer and Competition Commission (ICCC), has decided to decline authorisation for Kina Bank’s proposed acquisition of 89.91 per cent of Westpac PNG.

The decision, which appears final, follows a similar draft determination in late July and subsequent consultations with stakeholders, which ended on 20 August.

‘Likely effects on competition’ in Papua New Guinea’s banking sector appear to have strongly influenced the ICCC’s decision, which has effectively rejected the proposal by Kina Bank to run Westpac PNG as a stand-alone bank under a new name, East West Commercial Bank.

‘Although KSL proposed to operate the acquired business of Westpac PNG as a separate bank independent of Kina Bank, as East West Commercial Bank, the ICCC is not satisfied that they are separate banks, because of common ownership. Therefore, the ICCC did not consider them as separate banks,’ said ICCC Commissioner and Chief Executive Officer, Paulus Ain in a statement issued today.

‘The ICCC considers that Westpac PNG will be a significant source of competition for at least several years’

‘Currently, the markets are highly concentrated; and will remain so, as long as there are only few players in the markets. The number of commercial banks would be reduced to two with the acquisition, with small fringe non-bank financial institutions operating in some locations, with limited scale, scope and network economies,’ he said.

‘The barriers to entry and expansion are very high and the Proposed Acquisition would further heighten the barriers to entry as number of banks are reduced and giving more market power to the two existing incumbents.’

Less competition

The ICCC’s Paulus Ain

While the ICCC Commissioner acknowledged that the Westpac acquisition would allow Kina Bank to ‘gain scale, scope and network economies necessary to compete more effectively’ with PNG’s largest bank, BSP Financial Group, it suggested that ultimately this would ‘substantially lessen competition in the retail banking markets’.

‘The incentive to “coat-tail” and the ability to do so in a highly concentrated market would be very strong and likely to override the incentive to compete,’ Ain suggested.

In the absence of limited other competition from smaller, non-bank financial institutions (‘NBFIs’), he said the ICCC was ‘concerned that the Proposed Acquisition is likely to result in prices and profit margins increasing.’

The Commissioner also noted that the number of commercial banks in PNG has reduced already in recent years, following Kina Bank’s acquisition of Maybank in 2015 and its purchase of ANZ Bank’s PNG retail banking operation in 2019, and suggested that Westpac could continue trading in PNG.

‘Although Westpac has decided to divest its PNG business, it appears that this will not happen immediately without the proposed acquisition proceeding; hence the ICCC considers that Westpac PNG will be a significant source of competition for at least several years.’

Banks react

For their part, both Kina Bank and Westpac have issued brief statements today responding to the decision.

‘Westpac acknowledges the ICCC’s determination and will continue to operate these businesses while it reviews the impact on the sale to Kina Bank,’ said Westpac’s statement.

‘Kina is assessing the implications of the ICCC’s decision not to grant authorisation to the Acquisition and is considering its options. Kina will update the market when there is further information to announce,’ said Kina’s immediate response,’ was Kina Bank’s response.

At the end of July, Kina received regulatory approval to buy Westpac’s assets in Fiji. It is unclear at this stage if that acquisition will now go ahead.

Speak Your Mind